Automation on DoshFX: Simple Algo Trading Strategy

Nov 28, 2025

Explain that DoshFX is a multi-asset platform offering forex, commodities, indices, shares, and ETFs with fast execution and low spreads, which makes it suitable for systematic trading. Mention that its MT5 integration and automation-ready tools allow traders to turn clear rules into executable algorithms instead of relying on emotions

What is algorithmic trading

Define algorithmic trading in simple words: using predefined rules coded into a system to automatically place trades when conditions are met. Highlight benefits such as consistency, removal of emotional bias, and ability to monitor multiple markets at once.

Why DoshFX is suitable for automation

Add a short section on platform strengths:

MT5 integration with advanced charts and indicators.

Support for automated strategies and smart order routing.

Access to many instruments so the same logic can be applied across forex, indices, and commodities.

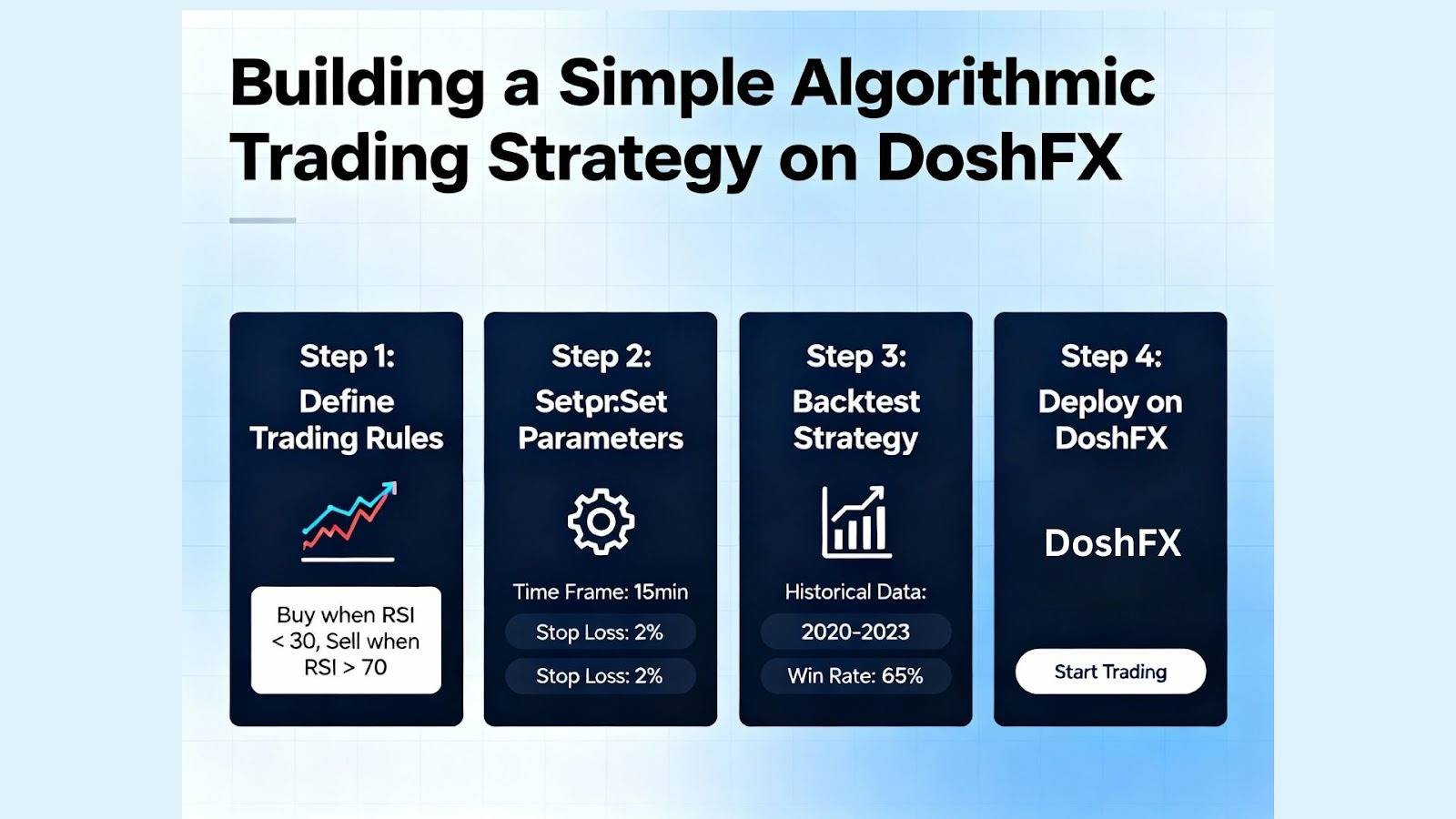

Step 1: Choose a simple strategy idea

Use a moving-average crossover as the core example:

Buy when a short-term moving average crosses above a long-term moving average (trend-following).

Sell when the short-term average crosses back below the long-term one.

Emphasize that this is only an educational example and not financial advice.

Step 2: Turn rules into clear logic

Break the logic into bullet points in the blog:

Entry rules for buy and sell.

Exit rules: opposite signal, stop-loss, and take-profit.

Risk per trade, for example a fixed percentage of account balance.

Explain that these rules later become code in MT5 or via an EA.

Step 3: Implement on DoshFX (high level)

Describe the process in platform-agnostic terms:

Open or log into a DoshFX account and connect the MT5 platform.

In MT5, use the strategy editor/Expert Advisor section to code or load a moving-average strategy.

Attach the strategy to a demo chart first so it trades virtually, not with real funds.

Avoid code snippets; instead, focus on explaining parameters (MA periods, lot size, stop-loss, take-profit, trading hours).

Step 4: Backtest before going live

Explain briefly what backtesting is: running the strategy on historical data to see how it would have performed. Advise readers to:

Check win rate, maximum drawdown, and profit factor.

Adjust parameters (MA periods, SL/TP, timeframes) and avoid curve-fitting.

Step 5: Risk management essentials

Add a practical risk section:

Never risk too much on a single trade; keep position size small relative to capital.

Use stop-losses and avoid running a strategy during major news events if it is not designed for volatility.

Start on demo or with very small live capital on DoshFX.

Common mistakes to avoid

List 3–5 short points:

Turning on automation without clear rules or backtesting.

Over-optimizing on past data so the system fails in real time.

Ignoring slippage, spreads, and execution speed.

Final CTA for your blog

End with a light call-to-action, for example: inviting readers to test a simple rule-based idea on a demo account via DoshFX and to keep learning about systematic trading and risk management.

If you tell the target word count and tone (formal/educational vs promotional for DoshFX), a full ready-to-publish draft can be written next.